Page 268 - Hitachi IR 2025

P. 268

NOTES TO THE FINANCIAL STATEMENTS

a) Trade receivables, financial assets and other current assets

The Company’s customer profile consists of a large number of customers spread across diverse

industries include public sector enterprises, state owned companies and large private corporates.

Accordingly, the Company’s customer credit risk is low. The Company’s projects business comprises

long-term contracts which have an execution period exceeding one year. General payment terms

include mobilisation advance, monthly progress payments with a credit period ranging from 0 to 90

days and certain retention money to be released at the end of the project. In some cases, retentions

are substituted with bank/corporate guarantees.

The Company follows ‘simplified approach’ for recognition of impairment allowance on trade receivable.

Under the simplified approach, the Company tracks changes in credit risk. Further, it recognizes

impairment allowance based on lifetime ECLs at each reporting date, right from initial recognition.

The Company uses a provision matrix to determine impairment allowance on the portfolio of trade

receivables. The provision matrix is based on its historically observed default rates over the expected

life of the trade receivable and is adjusted for forward looking estimates. At year end, the historical

observed default rates are updated and changes in the forward-looking estimates are analyzed.

Individual receivables which are known to be uncollectible are written off by reducing the carrying

amount of trade receivable and the amount of the loss is recognised in the statement of profit and loss

within other expenses.

Specific allowance for loss has also been provided by the management based on expected recovery

on individual parties.

The provision provided in books for trade receivables, financial assets and other current assets overdue:

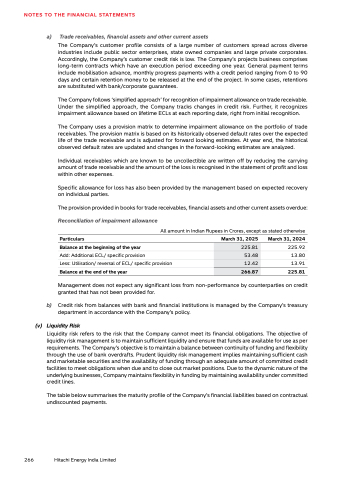

Reconciliation of impairment allowance

All amount in Indian Rupees in Crores, except as stated otherwise

Particulars March 31, 2025 March 31, 2024

Balance at the beginning of the year 225.81 225.92

Add: Additional ECL/ specific provision 53.48 13.80

Less: Utilisation/ reversal of ECL/ specific provision 12.42 13.91

Balance at the end of the year 266.87 225.81

Management does not expect any significant loss from non-performance by counterparties on credit

granted that has not been provided for.

b) Credit risk from balances with bank and financial institutions is managed by the Company’s treasury

department in accordance with the Company’s policy.

(v) Liquidity Risk

Liquidity risk refers to the risk that the Company cannot meet its financial obligations. The objective of

liquidity risk management is to maintain sufficient liquidity and ensure that funds are available for use as per

requirements. The Company’s objective is to maintain a balance between continuity of funding and flexibility

through the use of bank overdrafts. Prudent liquidity risk management implies maintaining sufficient cash

and marketable securities and the availability of funding through an adequate amount of committed credit

facilities to meet obligations when due and to close out market positions. Due to the dynamic nature of the

underlying businesses, Company maintains flexibility in funding by maintaining availability under committed

credit lines.

The table below summarises the maturity profile of the Company’s financial liabilities based on contractual

undiscounted payments.

266 Hitachi Energy India Limited