Page 270 - Hitachi IR 2025

P. 270

NOTES TO THE FINANCIAL STATEMENTS

In order to achieve this overall objective, the Company’s capital management, amongst other things, aims to

ensure that it meets financial covenants attached to the interest-bearing loans and borrowings that define capital

structure requirements. No changes were made in the objectives, policies or processes for managing capital

during the year ended March 31, 2025.

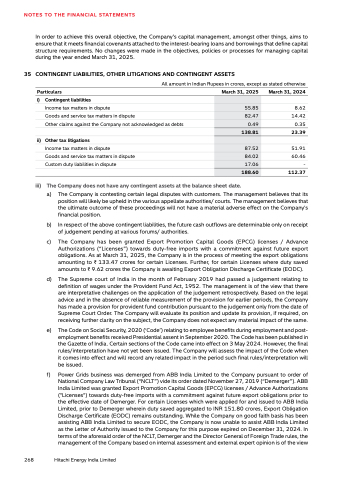

35 CONTINGENT LIABILITIES, OTHER LITIGATIONS AND CONTINGENT ASSETS

All amount in Indian Rupees in crores, except as stated otherwise

Particulars March 31, 2025 March 31, 2024

i) Contingent liabilities

Income tax matters in dispute 55.85 8.62

Goods and service tax matters in dispute 82.47 14.42

Other claims against the Company not acknowledged as debts 0.49 0.35

138.81 23.39

ii) Other tax litigations

Income tax matters in dispute 87.52 51.91

Goods and service tax matters in dispute 84.02 60.46

Custom duty liabilities in dispute 17.06 -

188.60 112.37

iii) The Company does not have any contingent assets at the balance sheet date.

a) The Company is contesting certain legal disputes with customers. The management believes that its

position will likely be upheld in the various appellate authorities/ courts. The management believes that

the ultimate outcome of these proceedings will not have a material adverse effect on the Company's

financial position.

b) c) d) e) f) In respect of the above contingent liabilities, the future cash outflows are determinable only on receipt

of judgement pending at various forums/ authorities.

The Company has been granted Export Promotion Capital Goods (EPCG) licenses / Advance

Authorizations (“Licenses”) towards duty-free imports with a commitment against future export

obligations. As at March 31, 2025, the Company is in the process of meeting the export obligations

amounting to ` 133.47 crores for certain Licenses. Further, for certain Licenses where duty saved

amounts to ` 9.62 crores the Company is awaiting Export Obligation Discharge Certificate (EODC).

The Supreme court of India in the month of February 2019 had passed a judgement relating to

definition of wages under the Provident Fund Act, 1952. The management is of the view that there

are interpretative challenges on the application of the judgement retrospectively. Based on the legal

advice and in the absence of reliable measurement of the provision for earlier periods, the Company

has made a provision for provident fund contribution pursuant to the judgement only from the date of

Supreme Court Order. The Company will evaluate its position and update its provision, if required, on

receiving further clarity on the subject, the Company does not expect any material impact of the same.

The Code on Social Security, 2020 (‘Code’) relating to employee benefits during employment and post-

employment benefits received Presidential assent in September 2020. The Code has been published in

the Gazette of India. Certain sections of the Code came into effect on 3 May 2024. However, the final

rules/interpretation have not yet been issued. The Company will assess the impact of the Code when

it comes into effect and will record any related impact in the period such final rules/interpretation will

be issued.

Power Grids business was demerged from ABB India Limited to the Company pursuant to order of

National Company Law Tribunal (“NCLT”) vide its order dated November 27, 2019 (“Demerger”). ABB

India Limited was granted Export Promotion Capital Goods (EPCG) licenses / Advance Authorizations

("Licenses") towards duty-free imports with a commitment against future export obligations prior to

the effective date of Demerger. For certain Licenses which were applied for and issued to ABB India

Limited, prior to Demerger wherein duty saved aggregated to INR 151.80 crores, Export Obligation

Discharge Certificate (EODC) remains outstanding. While the Company on good faith basis has been

assisting ABB India Limited to secure EODC, the Company is now unable to assist ABB India Limited

as the Letter of Authority issued to the Company for this purpose expired on December 31, 2024. In

terms of the aforesaid order of the NCLT, Demerger and the Director General of Foreign Trade rules, the

management of the Company based on internal assessment and external expert opinion is of the view

268 Hitachi Energy India Limited