Page 267 - Hitachi IR 2025

P. 267

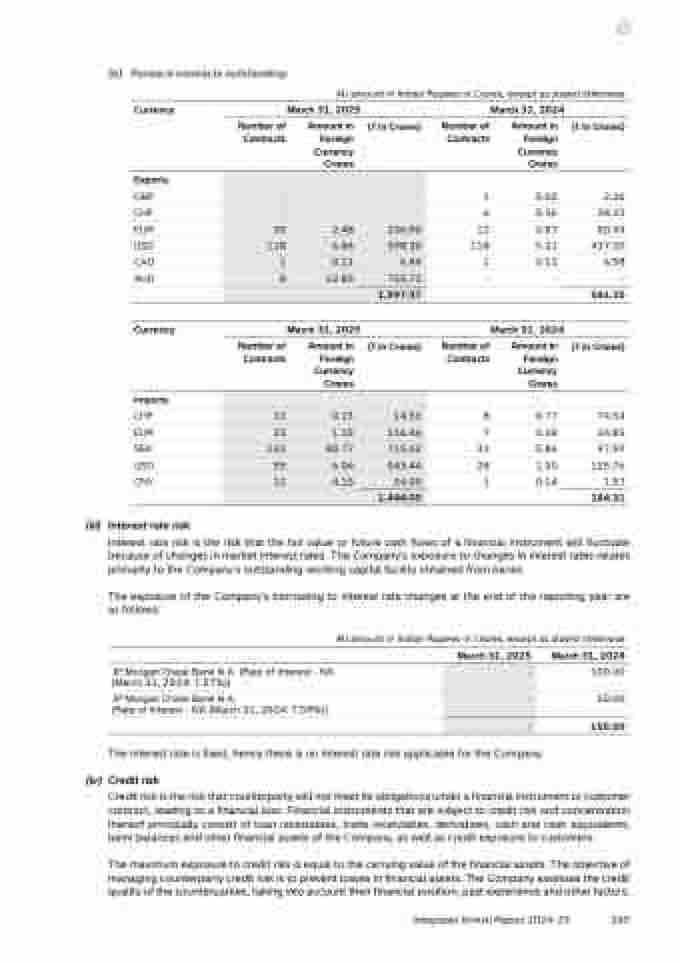

(b) Forward contracts outstanding:

All amount in Indian Rupees in Crores, except as stated otherwise

Currency March 31, 2025 March 31, 2024

Number of

Contracts

Amount in

Foreign

Currency

Crores

(` in Crores) Number of

Contracts

Amount in

Foreign

Currency

Crores

(` in Crores)

Exports

GBP - - - 1 0.02 2.26

CHF - - - 6 0.36 34.22

EUR 35 2.48 236.90 12 0.87 80.99

USD 118 6.86 598.30 118 5.21 437.30

CAD 1 0.11 6.44 1 0.11 6.58

AUD 8 12.85 755.73 - - -

1,597.37 561.35

Currency March 31, 2025 March 31, 2024

Number of

Contracts

Amount in

Foreign

Currency

Crores

(` in Crores) Number of

Contracts

Amount in

Foreign

Currency

Crores

(` in Crores)

Imports

CHF 13 0.15 14.53 8 0.77 74.54

EUR 23 1.15 116.46 7 0.38 34.85

SEK 133 80.77 715.62 31 5.86 47.59

USD 55 6.04 543.44 28 1.50 125.76

CNY 12 4.15 54.00 1 0.14 1.57

1,444.05 284.31

(iii) Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate

because of changes in market interest rates. The Company's exposure to changes in interest rates relates

primarily to the Company's outstanding working capital facility obtained from banks.

The exposure of the Company’s borrowing to interest rate changes at the end of the reporting year are

as follows:

All amount in Indian Rupees in Crores, except as stated otherwise

March 31, 2025 March 31, 2024

JP Morgan Chase Bank N.A. (Rate of Interest - NA

(March 31, 2024: 7.57%))

- 100.00

JP Morgan Chase Bank N.A.

(Rate of Interest - NA (March 31, 2024: 7.59%))

- 50.00

- 150.00

The interest rate is fixed, hence there is no interest rate risk applicable for the Company.

(iv) Credit risk

Credit risk is the risk that counterparty will not meet its obligations under a financial instrument or customer

contract, leading to a financial loss. Financial instruments that are subject to credit risk and concentration

thereof principally consist of loan receivables, trade receivables, derivatives, cash and cash equivalents,

bank balances and other financial assets of the Company, as well as credit exposure to customers.

The maximum exposure to credit risk is equal to the carrying value of the financial assets. The objective of

managing counterparty credit risk is to prevent losses in financial assets. The Company assesses the credit

quality of the counterparties, taking into account their financial position, past experience and other factors.

Integrated Annual Report 2024-25

265