Page 264 - Hitachi IR 2025

P. 264

NOTES TO THE FINANCIAL STATEMENTS

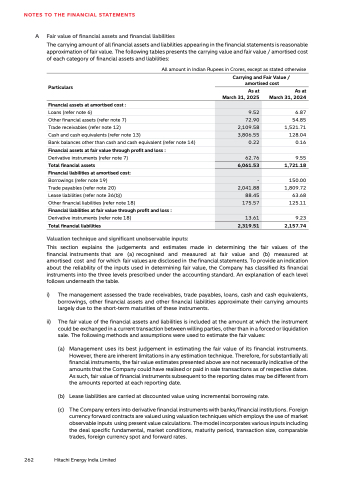

A Fair value of financial assets and financial liabilities

The carrying amount of all financial assets and liabilities appearing in the financial statements is reasonable

approximation of fair value. The following tables presents the carrying value and fair value / amortised cost

of each category of financial assets and liabilities:

All amount in Indian Rupees in Crores, except as stated otherwise

Carrying and Fair Value /

amortised cost

Particulars

As at

March 31, 2025

As at

March 31, 2024

Financial assets at amortised cost :

Loans (refer note 6) 9.52 6.87

Other financial assets (refer note 7) 72.90 54.85

Trade receivables (refer note 12) 2,109.58 1,521.71

Cash and cash equivalents (refer note 13) 3,806.55 128.04

Bank balances other than cash and cash equivalent (refer note 14) 0.22 0.16

Financial assets at fair value through profit and loss :

Derivative instruments (refer note 7) 62.76 9.55

Total financial assets 6,061.53 1,721.18

Financial liabilities at amortised cost:

Borrowings (refer note 19) - 150.00

Trade payables (refer note 20) 2,041.88 1,809.72

Lease liabilities (refer note 36(b)) 88.45 63.68

Other financial liabilities (refer note 18) 175.57 125.11

Financial liabilities at fair value through profit and loss :

Derivative instruments (refer note 18) 13.61 9.23

Total financial liabilities 2,319.51 2,157.74

Valuation technique and significant unobservable inputs:

This section explains the judgements and estimates made in determining the fair values of the

financial instruments that are (a) recognised and measured at fair value and (b) measured at

amortised cost and for which fair values are disclosed in the financial statements. To provide an indication

about the reliability of the inputs used in determining fair value, the Company has classified its financial

instruments into the three levels prescribed under the accounting standard. An explanation of each level

follows underneath the table.

i) ii) The management assessed the trade receivables, trade payables, loans, cash and cash equivalents,

borrowings, other financial assets and other financial liabilities approximate their carrying amounts

largely due to the short-term maturities of these instruments.

The fair value of the financial assets and liabilities is included at the amount at which the instrument

could be exchanged in a current transaction between willing parties, other than in a forced or liquidation

sale. The following methods and assumptions were used to estimate the fair values:

(a) Management uses its best judgement in estimating the fair value of its financial instruments.

However, there are inherent limitations in any estimation technique. Therefore, for substantially all

financial instruments, the fair value estimates presented above are not necessarily indicative of the

amounts that the Company could have realised or paid in sale transactions as of respective dates.

As such, fair value of financial instruments subsequent to the reporting dates may be different from

the amounts reported at each reporting date.

(b) Lease liabilities are carried at discounted value using incremental borrowing rate.

(c) The Company enters into derivative financial instruments with banks/financial institutions. Foreign

currency forward contracts are valued using valuation techniques which employs the use of market

observable inputs using present value calculations. The model incorporates various inputs including

the deal specific fundamental, market conditions, maturity period, transaction size, comparable

trades, foreign currency spot and forward rates.

262 Hitachi Energy India Limited