Page 263 - Hitachi IR 2025

P. 263

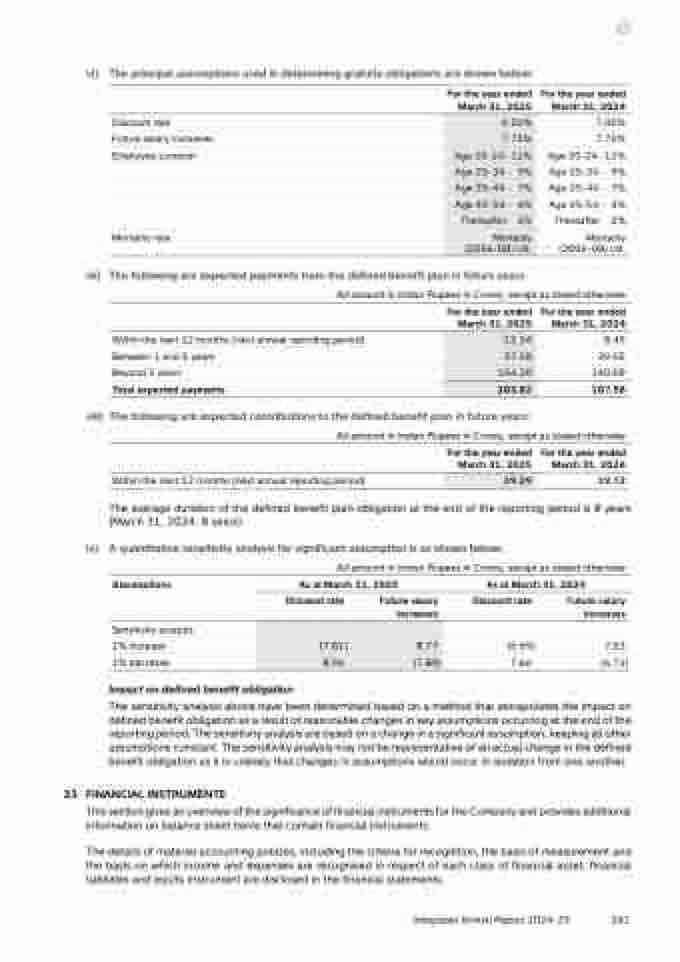

vi) The principal assumptions used in determining gratuity obligations are shown below:

For the year ended

March 31, 2025

For the year ended

March 31, 2024

Discount rate 6.50% 7.00%

Future salary increases 7.75% 7.75%

Employee turnover Age 20-24- 12% Age 20-24- 12%

Age 25-34 - 9% Age 25-34 - 9%

Age 35-44 - 7% Age 35-44 - 7%

Age 45-54 - 4% Age 45-54 - 4%

Thereafter 2% Thereafter 2%

Mortality rate Mortality

(2006-08) Ult.

Mortality

(2006-08) Ult.

vii) The following are expected payments from the defined benefit plan in future years:

All amount in Indian Rupees in Crores, except as stated otherwise

For the year ended

March 31, 2025

For the year ended

March 31, 2024

Within the next 12 months (next annual reporting period) 12.34 8.45

Between 1 and 5 years 37.28 39.05

Beyond 5 years 154.20 140.08

Total expected payments 203.82 187.58

viii) The following are expected contributions to the defined benefit plan in future years:

All amount in Indian Rupees in Crores, except as stated otherwise

For the year ended

March 31, 2025

For the year ended

March 31, 2024

Within the next 12 months (next annual reporting period) 29.29 19.72

ix) The average duration of the defined benefit plan obligation at the end of the reporting period is 8 years

(March 31, 2024: 8 years)

A quantitative sensitivity analysis for significant assumption is as shown below:

All amount in Indian Rupees in Crores, except as stated otherwise

Assumptions As at March 31, 2025 As at March 31, 2024

Discount rate Future salary

increases

Discount rate Future salary

increases

Sensitivity analysis

1% increase (7.81) 8.77 (6.69) 7.53

1% decrease 8.96 (7.80) 7.66 (6.71)

Impact on defined benefit obligation

The sensitivity analysis above have been determined based on a method that extrapolates the impact on

defined benefit obligation as a result of reasonable changes in key assumptions occurring at the end of the

reporting period. The sensitivity analysis are based on a change in a significant assumption, keeping all other

assumptions constant. The sensitivity analysis may not be representative of an actual change in the defined

benefit obligation as it is unlikely that changes in assumptions would occur in isolation from one another.

33 FINANCIAL INSTRUMENTS

This section gives an overview of the significance of financial instruments for the Company and provides additional

information on balance sheet items that contain financial instruments.

The details of material accounting policies, including the criteria for recognition, the basis of measurement and

the basis on which income and expenses are recognised in respect of each class of financial asset, financial

liabilities and equity instrument are disclosed in the financial statements.

Integrated Annual Report 2024-25

261