Page 261 - Hitachi IR 2025

P. 261

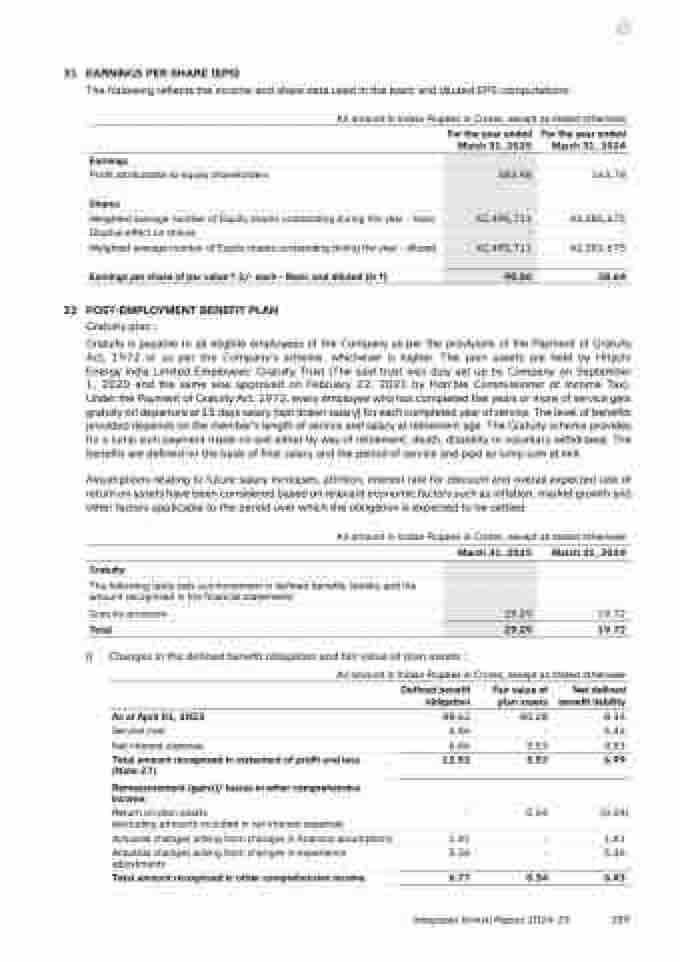

31 EARNINGS PER SHARE (EPS)

The following reflects the income and share data used in the basic and diluted EPS computations:

All amount in Indian Rupees in Crores, except as stated otherwise

For the year ended

March 31, 2025

For the year ended

March 31, 2024

Earnings

Profit attributable to equity shareholders 383.98 163.78

Shares

42,495,711 Weighted average number of Equity shares outstanding during the year - basic Weighted average number of Equity shares outstanding during the year - diluted 42,495,711 42,381,675

Dilutive effect on shares - -

42,381,675

Earnings per share of par value ` 2/- each - Basic and diluted (in `) 90.36 38.64

32 POST-EMPLOYMENT BENEFIT PLAN

Gratuity plan :

Gratuity is payable to all eligible employees of the Company as per the provisions of the Payment of Gratuity

Act, 1972 or as per the Company’s scheme, whichever is higher. The plan assets are held by Hitachi

Energy India Limited Employees' Gratuity Trust (The said trust was duly set up by Company on September

1, 2020 and the same was approved on February 22, 2021 by Hon'ble Commissioner of Income Tax).

Under the Payment of Gratuity Act, 1972, every employee who has completed five years or more of service gets

gratuity on departure at 15 days salary (last drawn salary) for each completed year of service. The level of benefits

provided depends on the member's length of service and salary at retirement age. The Gratuity scheme provides

for a lump sum payment made on exit either by way of retirement, death, disability or voluntary withdrawal. The

benefits are defined on the basis of final salary and the period of service and paid as lump sum at exit.

Assumptions relating to future salary increases, attrition, interest rate for discount and overall expected rate of

return on assets have been considered based on relevant economic factors such as inflation, market growth and

other factors applicable to the period over which the obligation is expected to be settled.

All amount in Indian Rupees in Crores, except as stated otherwise

March 31, 2025 March 31, 2024

Gratuity

The following table sets out movement in defined benefits liability and the

amount recognised in the financial statements:

Gratuity provision 29.29 19.72

Total 29.29 19.72

i) Changes in the defined benefit obligation and fair value of plan assets :

All amount in Indian Rupees in Crores, except as stated otherwise

Defined benefit

obligation

Fair value of

plan assets

Net defined

benefit liability

As at April 01, 2023 88.62 80.28 8.34

Service cost 6.46 - 6.46

Net interest expense 6.06 5.53 0.53

Total amount recognised in statement of profit and loss

(Note 27)

12.52 5.53 6.99

Remeasurement (gains)/ losses in other comprehensive

income:

Return on plan assets

(excluding amounts included in net interest expense)

- 0.34 (0.34)

Actuarial changes arising from changes in financial assumptions 1.41 - 1.41

Actuarial changes arising from changes in experience

adjustments

5.36 - 5.36

Total amount recognised in other comprehensive income 6.77 0.34 6.43

Integrated Annual Report 2024-25

259