Page 249 - Hitachi IR 2025

P. 249

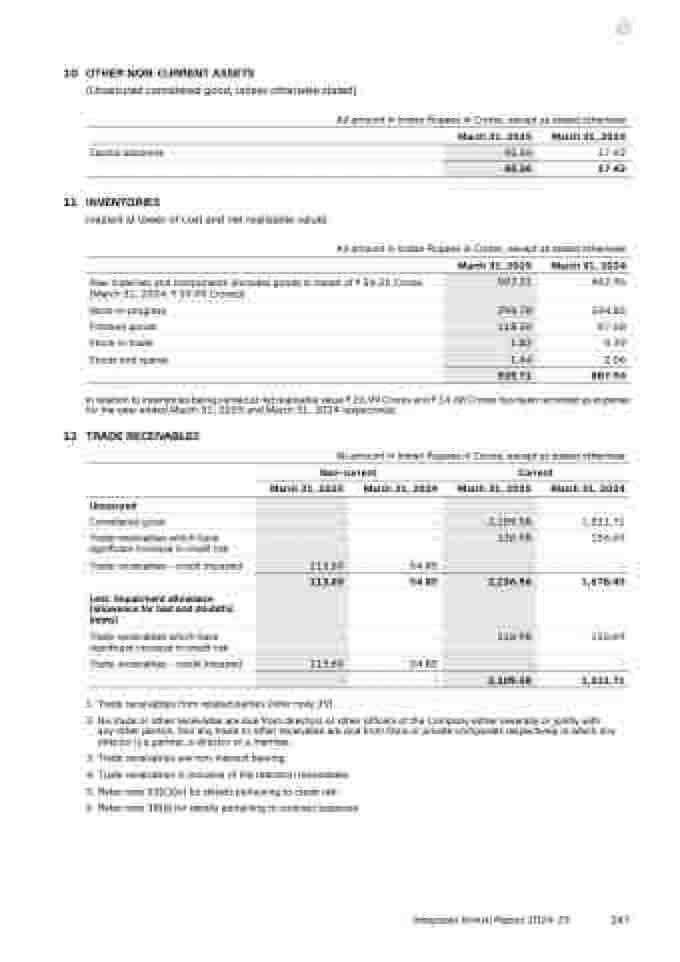

10 OTHER NON-CURRENT ASSETS

(Unsecured considered good, unless otherwise stated)

All amount in Indian Rupees in Crores, except as stated otherwise

March 31, 2025 March 31, 2024

Capital advances 45.36 17.42

45.36 17.42

11 INVENTORIES

(valued at lower of cost and net realisable value)

All amount in Indian Rupees in Crores, except as stated otherwise

March 31, 2025 March 31, 2024

507.31 462.96

Work-in-progress 296.78 334.85

Finished goods 118.36 87.68

Stock-in-trade 1.82 0.39

Stores and spares 1.44 2.06

Raw materials and components (includes goods in transit of ` 54.21 Crores

(March 31, 2024: ` 39.99 Crores))

925.71 887.94

In relation to inventories being carried at net realisable value ` 26.99 Crores and ` 14.68 Crores has been recorded as expense

for the year ended March 31, 2025 and March 31, 2024 respectively.

12 TRADE RECEIVABLES

All amount in Indian Rupees in Crores, except as stated otherwise

Non-current Current

March 31, 2025 March 31, 2024 March 31, 2025 March 31, 2024

Unsecured

Considered good - - 2,109.58 1,521.71

Trade receivables which have

significant increase in credit risk

- - 126.98 156.69

Trade receivables - credit impaired 113.69 54.85 - -

113.69 54.85 2,236.56 1,678.40

Less: Impairment allowance

(allowance for bad and doubtful

debts)

Trade receivables which have

significant increase in credit risk

- - 126.98 156.69

Trade receivables - credit impaired 113.69 54.85 - -

- - 2,109.58 1,521.71

1. Trade receivables from related parties (refer note 39).

2. No trade or other receivable are due from directors or other officers of the Company either severally or jointly with

any other person. Nor any trade or other receivable are due from firms or private companies respectively in which any

director is a partner, a director or a member.

3. Trade receivables are non-interest bearing.

4. Trade receivables is inclusive of the retention receivables.

5. Refer note 33(C)(iv) for details pertaining to credit risk.

6. Refer note 38(b) for details pertaining to contract balances.

Integrated Annual Report 2024-25

247