Page 250 - Hitachi IR 2025

P. 250

NOTES TO THE FINANCIAL STATEMENTS

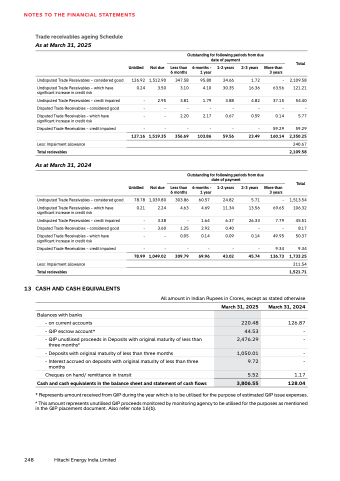

Trade receivables ageing Schedule

As at March 31, 2025

Outstanding for following periods from due

date of payment

Total

Unbilled Not due Less than

6 months

6 months -

1 year

1-2 years 2-3 years More than

3 years

Undisputed Trade Receivables – considered good 126.92 1,512.90 347.58 95.80 24.66 1.72 - 2,109.58

Undisputed Trade Receivables – which have

significant increase in credit risk

0.24 3.50 3.10 4.10 30.35 16.36 63.56 121.21

Undisputed Trade Receivables – credit impaired - 2.95 3.81 1.79 3.88 4.82 37.15 54.40

Disputed Trade Receivables – considered good - - - - - - - -

Disputed Trade Receivables – which have

significant increase in credit risk

- - 2.20 2.17 0.67 0.59 0.14 5.77

Disputed Trade Receivables – credit impaired - - - - - - 59.29 59.29

127.16 1,519.35 356.69 103.86 59.56 23.49 160.14 2,350.25

Less: Impairment allowance 240.67

Total recievables 2,109.58

As at March 31, 2024

Outstanding for following periods from due

date of payment

Total

Unbilled Not due Less than

6 months

6 months -

1 year

1-2 years 2-3 years More than

3 years

Undisputed Trade Receivables – considered good 78.78 1,039.80 303.86 60.57 24.82 5.71 - 1,513.54

0.21 2.24 4.63 4.69 11.34 13.56 69.65 106.32

Undisputed Trade Receivables – credit impaired - 3.38 - 1.64 6.37 26.33 7.79 45.51

Undisputed Trade Receivables – which have

significant increase in credit risk

- - 0.05 0.14 0.09 0.14 49.95 50.37

Disputed Trade Receivables – considered good - 3.60 1.25 2.92 0.40 - - 8.17

Disputed Trade Receivables – which have

significant increase in credit risk

Disputed Trade Receivables – credit impaired - - - - - - 9.34 9.34

78.99 1,049.02 309.79 69.96 43.02 45.74 136.73 1,733.25

Less: Impairment allowance 211.54

Total recievables 1,521.71

13 CASH AND CASH EQUIVALENTS

All amount in Indian Rupees in Crores, except as stated otherwise

March 31, 2025 March 31, 2024

Balances with banks

- on current accounts 220.48 126.87

- QIP escrow account* 44.53 -

- QIP unutilised proceeds in Deposits with original maturity of less than

three months#

2,476.29 -

- Deposits with original maturity of less than three months 1,050.01 -

- Interest accrued on deposits with original maturity of less than three

months

9.72 -

Cheques on hand/ remittance in transit 5.52 1.17

Cash and cash equivalents in the balance sheet and statement of cash flows 3,806.55 128.04

* Represents amount received from QIP during the year which is to be utilised for the purpose of estimated QIP issue expenses.

# This amount represents unutilised QIP proceeds monitored by monitoring agency to be utilised for the purposes as mentioned

in the QIP placement document. Also refer note 16(b).

248 Hitachi Energy India Limited