Page 248 - Hitachi IR 2025

P. 248

NOTES TO THE FINANCIAL STATEMENTS

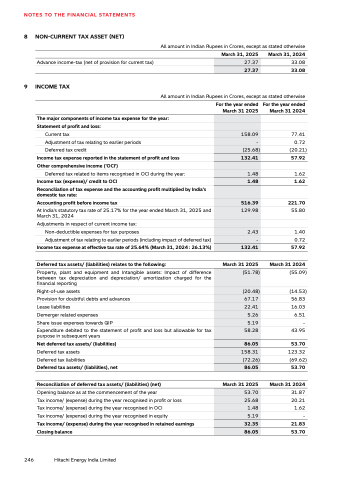

8 NON-CURRENT TAX ASSET (NET)

All amount in Indian Rupees in Crores, except as stated otherwise

March 31, 2025 March 31, 2024

Advance income-tax (net of provision for current tax) 27.37 33.08

27.37 33.08

9 INCOME TAX

All amount in Indian Rupees in Crores, except as stated otherwise

For the year ended

March 31 2025

For the year ended

March 31 2024

The major components of income tax expense for the year:

Statement of profit and loss:

Current tax 158.09 77.41

Adjustment of tax relating to earlier periods - 0.72

Deferred tax credit (25.68) (20.21)

Income tax expense reported in the statement of profit and loss 132.41 57.92

Other comprehensive income ('OCI')

Deferred tax related to items recognised in OCI during the year: 1.48 1.62

Income tax (expense)/ credit to OCI 1.48 1.62

Reconciliation of tax expense and the accounting profit multiplied by India’s

domestic tax rate:

Accounting profit before income tax 516.39 221.70

At India's statutory tax rate of 25.17% for the year ended March 31, 2025 and

March 31, 2024

129.98 55.80

Adjustments in respect of current income tax:

Non-deductible expenses for tax purposes 2.43 1.40

Adjustment of tax relating to earlier periods (including impact of deferred tax) - 0.72

Income tax expense at effective tax rate of 25.64% (March 31, 2024 : 26.13%) 132.41 57.92

March 31 2025 March 31 2024

(51.78) (55.09)

Right-of-use assets (20.48) (14.53)

Deferred tax assets/ (liabilities) relates to the following: Property, plant and equipment and Intangible assets: Impact of difference

between tax depreciation and depreciation/ amortization charged for the

financial reporting

58.28 43.95

Provision for doubtful debts and advances 67.17 56.83

Lease liabilities 22.41 16.03

Demerger related expenses 5.26 6.51

Share issue expenses towards QIP 5.19 -

Expenditure debited to the statement of profit and loss but allowable for tax

purpose in subsequent years

Net deferred tax assets/ (liabilities) 86.05 53.70

Deferred tax assets 158.31 123.32

Deferred tax liabilities (72.26) (69.62)

Deferred tax assets/ (liabilities), net 86.05 53.70

Reconciliation of deferred tax assets/ (liabilities) (net) March 31 2025 March 31 2024

Opening balance as at the commencement of the year 53.70 31.87

Tax income/ (expense) during the year recognised in profit or loss 25.68 20.21

Tax income/ (expense) during the year recognised in OCI 1.48 1.62

Tax income/ (expense) during the year recognised in equity 5.19 -

Tax income/ (expense) during the year recognised in retained earnings 32.35 21.83

Closing balance 86.05 53.70

246 Hitachi Energy India Limited