Page 247 - Hitachi IR 2025

P. 247

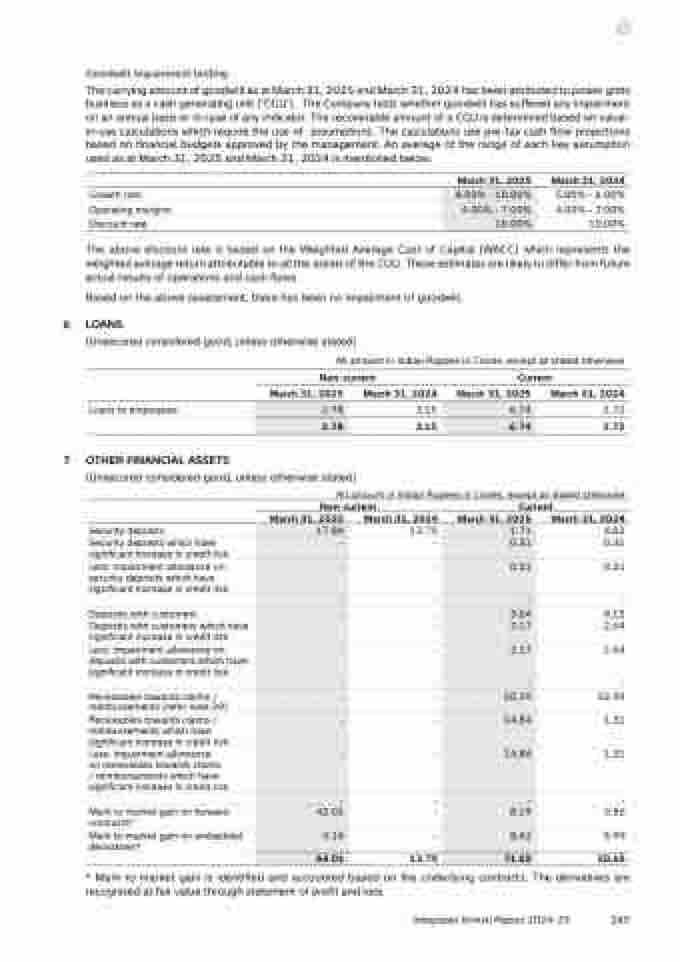

Goodwill impairment testing

The carrying amount of goodwill as at March 31, 2025 and March 31, 2024 has been attributed to power grids

business as a cash generating unit (‘CGU’) . The Company tests whether goodwill has suffered any impairment

on an annual basis or in case of any indicator. The recoverable amount of a CGU is determined based on value-

in-use calculations which require the use of assumptions. The calculations use pre-tax cash flow projections

based on financial budgets approved by the management. An average of the range of each key assumption

used as at March 31, 2025 and March 31, 2024 is mentioned below.

March 31, 2025 March 31, 2024

Growth rate 8.00% - 10.00% 5.00% - 6.00%

Operating margins 4.00% - 7.00% 4.00% - 7.00%

Discount rate 10.00% 10.00%

The above discount rate is based on the Weighted Average Cost of Capital (WACC) which represents the

weighted average return attributable to all the assets of the CGU. These estimates are likely to differ from future

actual results of operations and cash flows.

Based on the above assessment, there has been no impairment of goodwill.

6 LOANS

(Unsecured considered good, unless otherwise stated)

All amount in Indian Rupees in Crores, except as stated otherwise

Non-current Current

March 31, 2025 March 31, 2024 March 31, 2025 March 31, 2024

Loans to employees 2.78 3.15 6.74 3.72

2.78 3.15 6.74 3.72

7 OTHER FINANCIAL ASSETS

(Unsecured considered good, unless otherwise stated)

All amount in Indian Rupees in Crores, except as stated otherwise

Non-current Current

March 31, 2025 March 31, 2024 March 31, 2025 March 31, 2024

Security deposits 17.86 13.75 1.71 4.02

Security deposits which have

significant increase in credit risk

- - 0.31 0.31

Less: Impairment allowance on

security deposits which have

significant increase in credit risk

- - 0.31 0.31

- - - -

Deposits with customers - - 3.04 4.15

Deposits with customers which have

significant increase in credit risk

- 2.17 2.64

Less: Impairment allowance on

deposits with customers which have

significant increase in credit risk

- - 2.17 2.64

- - - -

Receivables towards claims /

reimbursements (refer note 39)

- - 50.29 32.93

Receivables towards claims /

reimbursements which have

significant increase in credit risk

- - 14.84 1.31

Less: Impairment allowance

on receivables towards claims

/ reimbursements which have

significant increase in credit risk

- - 14.84 1.31

- - - -

Mark to market gain on forward

contracts*

42.01 - 8.19 3.56

Mark to market gain on embedded

derivatives*

4.14 - 8.42 5.99

64.01 13.75 71.65 50.65

* Mark to market gain is identified and accounted based on the underlying contracts. The derivatives are

recognised at fair value through statement of profit and loss.

Integrated Annual Report 2024-25

245