Page 190 - Hitachi IR 2025

P. 190

BOARD’S REPORT

j) k) As on March 31, 2025, out of 4,45,72,363 equity shares of the Company 4,43,81,976 equity shares have

been dematerialized representing 99.57%. The Company confirms that the promoters’ holdings continued

to be in electronic form and the same is in line with the circulars issued by SEBI.

Members who are still holding shares in physical form are requested to dematerialize their shares at

the earliest, this will be more advantageous to deal in securities. For queries/ clarification/ assistance,

shareholders are advised to approach the Company’s Registrar and Share Transfer Agents.

Outstanding GDRs / ADRs / Warrants or any Convertible Instruments, Conversion Date and Likely Impact

on Equity:

The Company has not issued GDRs, ADRs or any other Convertible Instruments and as such, there is no

impact on the equity share capital of the Company.

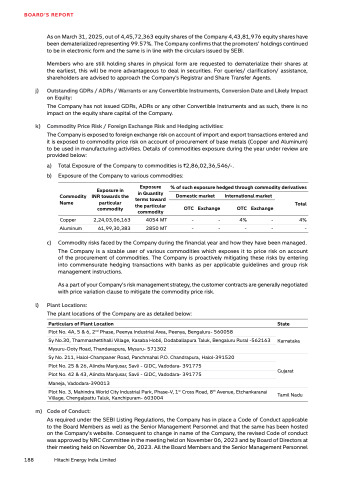

Commodity Price Risk / Foreign Exchange Risk and Hedging activities:

The Company is exposed to foreign exchange risk on account of import and export transactions entered and

it is exposed to commodity price risk on account of procurement of base metals (Copper and Aluminum)

to be used in manufacturing activities. Details of commodities exposure during the year under review are

provided below:

a) Total Exposure of the Company to commodities is `2,86,02,36,546/-.

b) Exposure of the Company to various commodities:

Commodity

Name

Total

Copper 2,24,03,06,163 4054 MT - - 4% - 4%

Aluminum 61,99,30,383 2850 MT - - - - -

c) Exposure in

INR towards the

particular

commodity

Exposure

in Quantity

terms toward

the particular

commodity

% of such exposure hedged through commodity derivatives

Domestic market International market

OTC Exchange OTC Exchange

Commodity risks faced by the Company during the financial year and how they have been managed.

The Company is a sizable user of various commodities which exposes it to price risk on account

of the procurement of commodities. The Company is proactively mitigating these risks by entering

into commensurate hedging transactions with banks as per applicable guidelines and group risk

management instructions.

As a part of your Company’s risk management strategy, the customer contracts are generally negotiated

with price variation clause to mitigate the commodity price risk.

l) Plant Locations:

The plant locations of the Company are as detailed below:

Particulars of Plant Location State

Plot No. 4A, 5 & 6, 2nd Phase, Peenya Industrial Area, Peenya, Bengaluru- 560058

Sy No.30, Thammashettihalli Village, Kasaba Hobli, Dodaballapura Taluk, Bengaluru Rural -562163

Karnataka

Mysuru-Ooty Road, Thandavapura, Mysuru- 571302

Sy No. 211, Halol-Champaner Road, Panchmahal P.O. Chandrapura, Halol-391520

Plot No. 25 & 26, Alindra Manjusar, Savli - GIDC, Vadodara- 391775

Gujarat

Plot No. 42 & 43, Alindra Manjusar, Savli - GIDC, Vadodara- 391775

Maneja, Vadodara-390013

Plot No. 3, Mahindra World City Industrial Park, Phase-V, 1st Cross Road, 8th Avenue, Etchankaranai

Village, Chengalpattu Taluk, Kanchipuram- 603004 Tamil Nadu

m) Code of Conduct:

As required under the SEBI Listing Regulations, the Company has in place a Code of Conduct applicable

to the Board Members as well as the Senior Management Personnel and that the same has been hosted

on the Company’s website. Consequent to change in name of the Company, the revised Code of conduct

was approved by NRC Committee in the meeting held on November 06, 2023 and by Board of Directors at

their meeting held on November 06, 2023. All the Board Members and the Senior Management Personnel

188 Hitachi Energy India Limited