Page 192 - Hitachi IR 2025

P. 192

BOARD’S REPORT

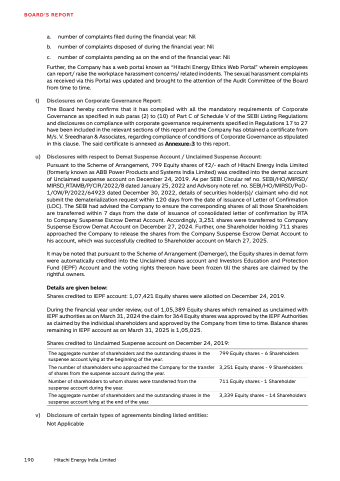

t) u) a. number of complaints filed during the financial year: Nil

b. number of complaints disposed of during the financial year: Nil

c. number of complaints pending as on the end of the financial year: Nil

Further, the Company has a web portal known as “Hitachi Energy Ethics Web Portal” wherein employees

can report/ raise the workplace harassment concerns/ related incidents. The sexual harassment complaints

as received via this Portal was updated and brought to the attention of the Audit Committee of the Board

from time to time.

Disclosures on Corporate Governance Report:

The Board hereby confirms that it has complied with all the mandatory requirements of Corporate

Governance as specified in sub paras (2) to (10) of Part C of Schedule V of the SEBI Listing Regulations

and disclosures on compliance with corporate governance requirements specified in Regulations 17 to 27

have been included in the relevant sections of this report and the Company has obtained a certificate from

M/s. V. Sreedharan & Associates, regarding compliance of conditions of Corporate Governance as stipulated

in this clause. The said certificate is annexed as Annexure-3 to this report.

Disclosures with respect to Demat Suspense Account / Unclaimed Suspense Account:

Pursuant to the Scheme of Arrangement, 799 Equity shares of `2/- each of Hitachi Energy India Limited

(formerly known as ABB Power Products and Systems India Limited) was credited into the demat account

of Unclaimed suspense account on December 24, 2019. As per SEBI Circular ref no. SEBI/HO/MIRSD/

MIRSD_RTAMB/P/CIR/2022/8 dated January 25, 2022 and Advisory note ref. no. SEBI/HO/MIRSD/PoD-

1/OW/P/2022/64923 dated December 30, 2022, details of securities holder(s)/ claimant who did not

submit the dematerialization request within 120 days from the date of issuance of Letter of Confirmation

(LOC). The SEBI had advised the Company to ensure the corresponding shares of all those Shareholders

are transferred within 7 days from the date of issuance of consolidated letter of confirmation by RTA

to Company Suspense Escrow Demat Account. Accordingly, 3,251 shares were transferred to Company

Suspense Escrow Demat Account on December 27, 2024. Further, one Shareholder holding 711 shares

approached the Company to release the shares from the Company Suspense Escrow Demat Account to

his account, which was successfully credited to Shareholder account on March 27, 2025.

It may be noted that pursuant to the Scheme of Arrangement (Demerger), the Equity shares in demat form

were automatically credited into the Unclaimed shares account and Investors Education and Protection

Fund (IEPF) Account and the voting rights thereon have been frozen till the shares are claimed by the

rightful owners.

Details are given below:

Shares credited to IEPF account: 1,07,421 Equity shares were allotted on December 24, 2019.

During the financial year under review, out of 1,05,389 Equity shares which remained as unclaimed with

IEPF authorities as on March 31, 2024 the claim for 364 Equity shares was approved by the IEPF Authorities

as claimed by the individual shareholders and approved by the Company from time to time. Balance shares

remaining in IEPF account as on March 31, 2025 is 1,05,025.

Shares credited to Unclaimed Suspense account on December 24, 2019:

The aggregate number of shareholders and the outstanding shares in the

suspense account lying at the beginning of the year.

799 Equity shares – 6 Shareholders

The number of shareholders who approached the Company for the transfer

of shares from the suspense account during the year.

3,251 Equity shares - 9 Shareholders

Number of shareholders to whom shares were transferred from the

suspense account during the year.

711 Equity shares - 1 Shareholder

The aggregate number of shareholders and the outstanding shares in the

suspense account lying at the end of the year.

3,339 Equity shares – 14 Shareholders

v) Disclosure of certain types of agreements binding listed entities:

Not Applicable

190 Hitachi Energy India Limited