Page 191 - Hitachi IR 2025

P. 191

n) o) p) q) r) s) have affirmed compliance with the Code of Conduct, as on March 31, 2025. A certificate to that effect is

annexed as Annexure-2.

In accordance with the Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations,

2015, the Company has, inter-alia, adopted a Code of Conduct for Prohibition of Insider Trading Code of

Practices and Procedures for Fair Disclosure of Unpublished Price Sensitive Information (Code) duly revised

on February 09, 2022.

As per the above Code, Mr. Poovanna Ammatanda is the Compliance Officer and Mr. Ajay Singh, Chief

Financial Officer is the Chief Investor Relations Officer.

Company affirms that all the requirements under the SEBI Listing Regulations are complied with.

Debenture Trustees - Not Applicable.

Details of utilization of funds raised through preferential allotment or QIP as specified under Regulation 32

(7A) of the SEBI Listing Regulations:

During the year under review, the Fund Raise Committee of the Board of Directors of the Company on

March 13, 2025 approved allotment of 21,90,688 Equity Shares of face value `2 each at an issue price

of `11,507.00 per Equity Share (including a premium of `11,505.00 per Equity Share, post considering

a discount of 5% on the Floor Price amounting to `605.50 per Equity Share) aggregating to `2,520.82

Crores (gross proceeds) via QIP to Qualified Institutional Buyers. The utilisation of proceeds/funds raised

from the QIP are reviewed by Audit Committee as part of quarterly review of financial results and the details

are also filed with the Stock Exchanges on a quarterly basis, pursuant to Regulation 32 of the SEBI Listing

Regulations. During the year under review, the Company has not utilized the net proceeds i.e., `2,476.29

Crores, raised through the QIP out of the total gross proceeds amounting to `2,520.82 Crores raised

through the issuance. Further, the amount will be utilized for the objects of the issue as stipulated in the

Placement Document and the utilization will be reviewed by Audit Committee as part of quarterly review

of financial results and the details will also be filed with the Stock Exchanges on a quarterly basis.

Where the board had not accepted any recommendation of any committee of the board, which is mandatorily

required in the relevant financial year, the same to be disclosed along with reasons thereof - Not applicable.

Total fees for all services paid by the listed entity and its subsidiaries, on a consolidated basis, to the statutory

auditor and all entities in the network firm / network entity of which the statutory auditor is a part:

During the financial year under review, the company did not have any subsidiaries. Based on the

recommendation of the Audit Committee and Board of Directors, Shareholders approved the appointment

of M/s. S.R. Batliboi & Associates LLP, Chartered Accountants (Registration No. 101049W/E300004) as

the Statutory Auditors of the Company commencing from the conclusion of the 1st Annual General Meeting

to hold such office for a period of 5 years till the conclusion of 6th Annual General Meeting. Remuneration

approved was `3,35,28,711/- (Rupees Three Crores Thirty Five Lakhs Twenty Eight Thousand Seven

Hundred Eleven only) for the financial year 2024-25 (April 01, 2024 to March 31, 2025) plus applicable

taxes in connection with the statutory audit of the Company and related services.

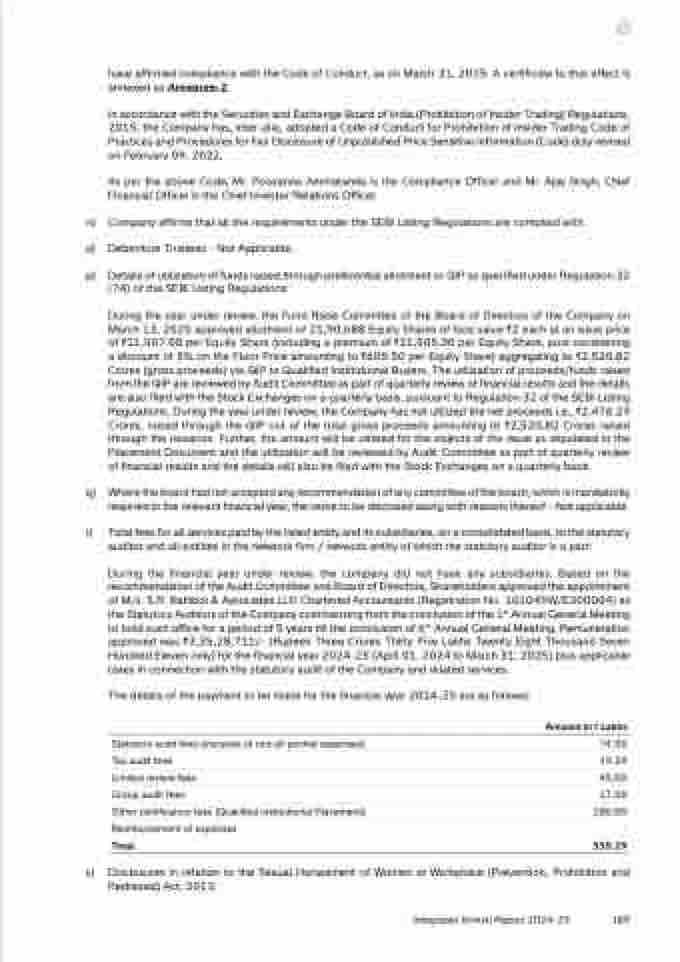

The details of the payment to be made for the financial year 2024-25 are as follows:

Amount in ` Lakhs

Statutory audit fees (inclusive of out-of-pocket expenses) 74.00

Tax audit fees 19.29

Limited review fees 45.00

Group audit fees 17.00

Other certification fees (Qualified Institutional Placement) 180.00

Reimbursement of expenses -

Total 335.29

Disclosures in relation to the Sexual Harassment of Women at Workplace (Prevention, Prohibition and

Redressal) Act, 2013:

Integrated Annual Report 2024-25

189