Page 236 - Hitachi IR 2025

P. 236

NOTES TO THE FINANCIAL STATEMENTS

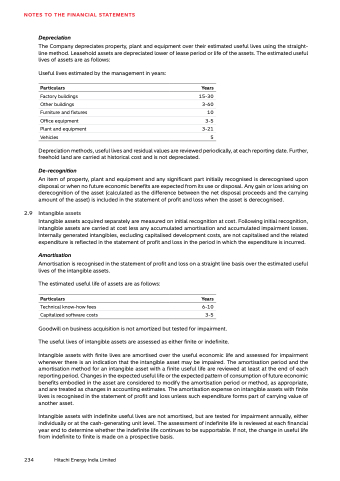

Depreciation

The Company depreciates property, plant and equipment over their estimated useful lives using the straight-

line method. Leasehold assets are depreciated lower of lease period or life of the assets. The estimated useful

lives of assets are as follows:

Useful lives estimated by the management in years:

Particulars Years

Factory buildings 15-30

Other buildings 3-60

Furniture and fixtures 10

Office equipment 3-5

Plant and equipment 3-21

Vehicles 5

Depreciation methods, useful lives and residual values are reviewed periodically, at each reporting date. Further,

freehold land are carried at historical cost and is not depreciated.

De-recognition

An item of property, plant and equipment and any significant part initially recognised is derecognised upon

disposal or when no future economic benefits are expected from its use or disposal. Any gain or loss arising on

derecognition of the asset (calculated as the difference between the net disposal proceeds and the carrying

amount of the asset) is included in the statement of profit and loss when the asset is derecognised.

2.9 Intangible assets

Intangible assets acquired separately are measured on initial recognition at cost. Following initial recognition,

intangible assets are carried at cost less any accumulated amortisation and accumulated impairment losses.

Internally generated intangibles, excluding capitalised development costs, are not capitalised and the related

expenditure is reflected in the statement of profit and loss in the period in which the expenditure is incurred.

Amortisation

Amortisation is recognised in the statement of profit and loss on a straight line basis over the estimated useful

lives of the intangible assets.

The estimated useful life of assets are as follows:

Particulars Years

Technical know-how fees 6-10

Capitalized software costs 3-5

Goodwill on business acquisition is not amortized but tested for impairment.

The useful lives of intangible assets are assessed as either finite or indefinite.

Intangible assets with finite lives are amortised over the useful economic life and assessed for impairment

whenever there is an indication that the intangible asset may be impaired. The amortisation period and the

amortisation method for an intangible asset with a finite useful life are reviewed at least at the end of each

reporting period. Changes in the expected useful life or the expected pattern of consumption of future economic

benefits embodied in the asset are considered to modify the amortisation period or method, as appropriate,

and are treated as changes in accounting estimates. The amortisation expense on intangible assets with finite

lives is recognised in the statement of profit and loss unless such expenditure forms part of carrying value of

another asset.

Intangible assets with indefinite useful lives are not amortised, but are tested for impairment annually, either

individually or at the cash-generating unit level. The assessment of indefinite life is reviewed at each financial

year end to determine whether the indefinite life continues to be supportable. If not, the change in useful life

from indefinite to finite is made on a prospective basis.

234 Hitachi Energy India Limited