Page 234 - Hitachi IR 2025

P. 234

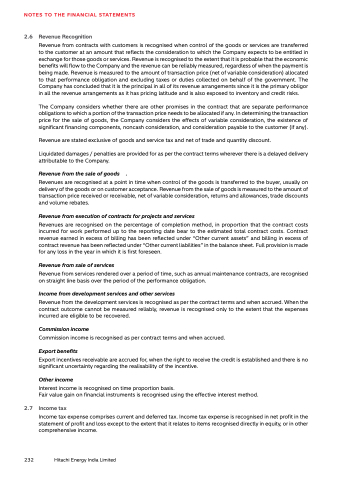

NOTES TO THE FINANCIAL STATEMENTS

2.6 Revenue Recognition

Revenue from contracts with customers is recognised when control of the goods or services are transferred

to the customer at an amount that reflects the consideration to which the Company expects to be entitled in

exchange for those goods or services. Revenue is recognised to the extent that it is probable that the economic

benefits will flow to the Company and the revenue can be reliably measured, regardless of when the payment is

being made. Revenue is measured to the amount of transaction price (net of variable consideration) allocated

to that performance obligation and excluding taxes or duties collected on behalf of the government. The

Company has concluded that it is the principal in all of its revenue arrangements since it is the primary obligor

in all the revenue arrangements as it has pricing latitude and is also exposed to inventory and credit risks.

The Company considers whether there are other promises in the contract that are separate performance

obligations to which a portion of the transaction price needs to be allocated if any. In determining the transaction

price for the sale of goods, the Company considers the effects of variable consideration, the existence of

significant financing components, noncash consideration, and consideration payable to the customer (if any).

Revenue are stated exclusive of goods and service tax and net of trade and quantity discount.

Liquidated damages / penalties are provided for as per the contract terms wherever there is a delayed delivery

attributable to the Company.

Revenue from the sale of goods .

Revenues are recognised at a point in time when control of the goods is transferred to the buyer, usually on

delivery of the goods or on customer acceptance. Revenue from the sale of goods is measured to the amount of

transaction price received or receivable, net of variable consideration, returns and allowances, trade discounts

and volume rebates.

Revenue from execution of contracts for projects and services

Revenues are recognised on the percentage of completion method, in proportion that the contract costs

incurred for work performed up to the reporting date bear to the estimated total contract costs. Contract

revenue earned in excess of billing has been reflected under “Other current assets” and billing in excess of

contract revenue has been reflected under “Other current liabilities” in the balance sheet. Full provision is made

for any loss in the year in which it is first foreseen.

Revenue from sale of services

Revenue from services rendered over a period of time, such as annual maintenance contracts, are recognised

on straight line basis over the period of the performance obligation.

Income from development services and other services

Revenue from the development services is recognised as per the contract terms and when accrued. When the

contract outcome cannot be measured reliably, revenue is recognised only to the extent that the expenses

incurred are eligible to be recovered.

Commission income

Commission income is recognised as per contract terms and when accrued.

Export benefits

Export incentives receivable are accrued for, when the right to receive the credit is established and there is no

significant uncertainty regarding the realisability of the incentive.

Other income

Interest income is recognised on time proportion basis.

Fair value gain on financial instruments is recognised using the effective interest method.

2.7 Income tax

Income tax expense comprises current and deferred tax. Income tax expense is recognised in net profit in the

statement of profit and loss except to the extent that it relates to items recognised directly in equity, or in other

comprehensive income.

232 Hitachi Energy India Limited