Page 228 - Hitachi IR 2025

P. 228

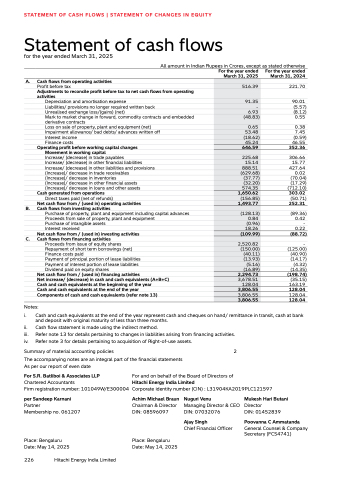

STATEMENT OF CASH FLOWS | STATEMENT OF CHANGES IN EQUITY

Statement of cash flows

for the year ended March 31, 2025

All amount in Indian Rupees in Crores, except as stated otherwise

For the year ended

March 31, 2025

For the year ended

March 31, 2024

A. Cash flows from operating activities

Profit before tax 516.39 221.70

Adjustments to reconcile profit before tax to net cash flows from operating

activities

Depreciation and amortisation expense 91.35 90.01

Liabilities/ provisions no longer required written back - (5.57)

Unrealised exchange loss/(gains) (net) 6.93 (8.12)

Mark to market change in forward, commodity contracts and embedded

derivative contracts

(48.83) 0.55

Loss on sale of property, plant and equipment (net) 0.65 0.38

Impairment allowance/ bad debts/ advances written off 53.48 7.45

Interest income (18.62) (0.59)

Finance costs 45.24 46.55

Operating profit before working capital changes 646.59 352.36

Movement in working capital

Increase/ (decrease) in trade payables 225.68 306.66

Increase/ (decrease) in other financial liabilities 15.14 15.77

Increase/ (decrease) in other liabilities and provisions 888.51 427.64

(Increase)/ decrease in trade receivables (629.68) 0.02

(Increase)/ decrease in inventories (37.77) (70.04)

(Increase)/ decrease in other financial assets (32.20) (17.29)

(Increase)/ decrease in loans and other assets 574.35 (712.10)

Cash generated from operations 1,650.62 303.02

Direct taxes paid (net of refunds) (156.85) (50.71)

Net cash flow from / (used in) operating activities 1,493.77 252.31

B. Cash flows from investing activities

Purchase of property, plant and equipment including capital advances (128.13) (89.36)

Proceeds from sale of property, plant and equipment 0.84 0.42

Purchase of intangible assets (0.96) -

Interest received 18.26 0.22

Net cash flow from / (used in) investing activities (109.99) (88.72)

C. Cash flows from financing activities

Proceeds from issue of equity shares 2,520.82 -

Repayment of short term borrowings (net) (150.00) (125.00)

Finance costs paid (40.11) (40.90)

Payment of principal portion of lease liabilities (13.93) (14.17)

Payment of interest portion of lease liabilities (5.16) (4.32)

Dividend paid on equity shares (16.89) (14.35)

Net cash flow from / (used in) financing activities Net increase/ (decrease) in cash and cash equivalents (A+B+C) 2,294.73 3,678.51 (198.74)

(35.15)

Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the year 128.04 3,806.55 163.19

128.04

Components of cash and cash equivalents (refer note 13) 3,806.55 128.04

3,806.55 128.04

Notes:

i. ii. iii. iv. Cash and cash equivalents at the end of the year represent cash and cheques on hand/ remittance in transit, cash at bank

and deposit with original maturity of less than three months.

Cash flow statement is made using the indirect method.

Refer note 13 for details pertaining to changes in liabilities arising from financing activities.

Refer note 3 for details pertaining to acquisition of Right-of-use assets.

Summary of material accounting policies 2

The accompanying notes are an integral part of the financial statements

As per our report of even date

For S.R. Batliboi & Associates LLP Chartered Accountants Firm registration number: 101049W/E300004 For and on behalf of the Board of Directors of

Hitachi Energy India Limited

Corporate identity number (CIN) : L31904KA2019PLC121597

per Sandeep Karnani Partner Achim Michael Braun Nuguri Venu Mukesh Hari Butani

Chairman & Director Managing Director & CEO Director

Membership no. 061207 DIN: 08596097 DIN: 07032076 DIN: 01452839

Ajay Singh Poovanna C Ammatanda

Chief Financial Officer General Counsel & Company

Secretary (FCS4741)

Place: Bengaluru Place: Bengaluru

Date: May 14, 2025 Date: May 14, 2025

226 Hitachi Energy India Limited