Page 221 - Hitachi IR 2025

P. 221

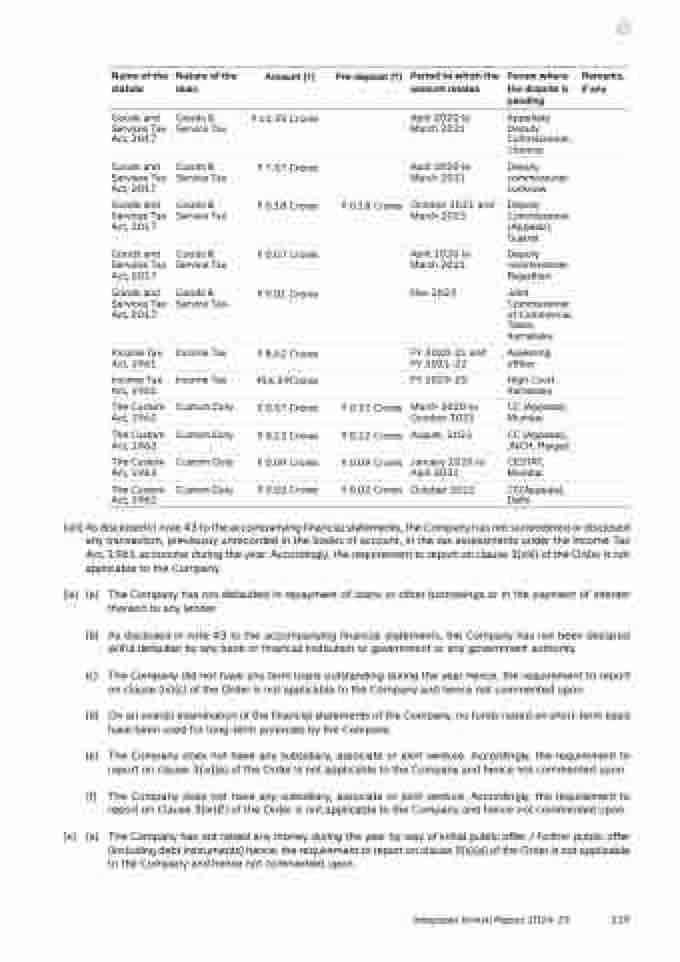

Name of the

statute

Nature of the

dues

Amount (`) Pre-deposit (`) Period to which the

amount relates

Forum where

the dispute is

pending

Remarks,

if any

Goods and

Services Tax

Act, 2017

Goods &

Service Tax

` 13.45 Crores April 2020 to

March 2021

Appellate

Deputy

Commissioner,

Chennai

Goods and

Services Tax

Act, 2017

Goods &

Service Tax

` 7.57 Crores April 2020 to

March 2021

Deputy

commissioner.

Lucknow

Goods and

Services Tax

Act, 2017

Goods &

Service Tax

` 0.18 Crores ` 0.18 Crores October 2021 and

March 2023

Deputy

Commissioner

(Appeals),

Gujarat

Goods and

Services Tax

Act, 2017

Goods &

Service Tax

` 0.07 Crores April 2020 to

March 2021

Deputy

commissioner.

Rajasthan

Goods and

Services Tax

Act, 2017

Goods &

Service Tax-

` 0.01 Crores Nov 2023 Joint

Commissioner

of Commercial

Taxes,

Karnataka

Income Tax

Act, 1961

Assessing

officer

Income Tax

Act, 1961

Income Tax ` 8.62 Crores FY 2020-21 and

FY 2021-22

Income Tax `54.39Crores FY 2019-20 High Court,

Karnataka

The Custom

Act, 1962

Custom Duty ` 0.57 Crores ` 0.57 Crores March 2020 to

October 2022

CC (Appeals),

Mumbai

Custom Duty ` 0.12 Crores ` 0.12 Crores August, 2022 CC (Appeals),

JNCH, Raigad

The Custom

Act, 1962

Custom Duty ` 0.09 Crores ` 0.09 Crores January 2020 to

April 2021

CESTAT,

Mumbai

The Custom

Act, 1962

Custom Duty ` 0.02 Crores ` 0.02 Crores October 2022 CC(Appeals),

Delhi

The Custom

Act, 1962

(viii) As disclosed in note 43 to the accompanying financial statements, the Company has not surrendered or disclosed

any transaction, previously unrecorded in the books of account, in the tax assessments under the Income Tax

Act, 1961 as income during the year. Accordingly, the requirement to report on clause 3(viii) of the Order is not

applicable to the Company.

(ix) (a) The Company has not defaulted in repayment of loans or other borrowings or in the payment of interest

thereon to any lender.

(b) As disclosed in note 43 to the accompanying financial statements, the Company has not been declared

wilful defaulter by any bank or financial institution or government or any government authority.

(c) The Company did not have any term loans outstanding during the year hence, the requirement to report

on clause (ix)(c) of the Order is not applicable to the Company and hence not commented upon.

(d) On an overall examination of the financial statements of the Company, no funds raised on short-term basis

have been used for long-term purposes by the Company.

(e) The Company does not have any subsidiary, associate or joint venture. Accordingly, the requirement to

report on clause 3(ix)(e) of the Order is not applicable to the Company and hence not commented upon.

(f) The Company does not have any subsidiary, associate or joint venture. Accordingly, the requirement to

report on Clause 3(ix)(f) of the Order is not applicable to the Company and hence not commented upon.

(x) (a) The Company has not raised any money during the year by way of initial public offer / further public offer

(including debt instruments) hence, the requirement to report on clause 3(x)(a) of the Order is not applicable

to the Company and hence not commented upon.

Integrated Annual Report 2024-25

219