Page 282 - Hitachi IR 2025

P. 282

NOTES TO THE FINANCIAL STATEMENTS

g) Nature of CSR activities:

i. Promote gender equality and empowering of women in engineering workforce

ii. Endorse Education, employability & healthcare

iii. Social impact projects

iv. Support national disaster management and other government initiatives

v. Aid in sustainable development goals

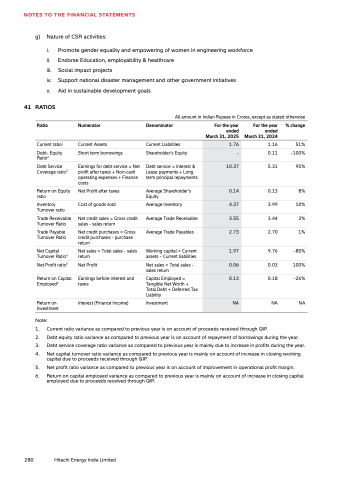

41 RATIOS

All amount in Indian Rupees in Crores, except as stated otherwise

Current ratio1 Current Assets Current Liabilities 1.76 1.16 51%

Debt Service

Coverage ratio3

Ratio Numerator Denominator For the year

ended

March 31, 2025

For the year

ended

March 31, 2024

Debt service = Interest &

Lease payments + Long

term principal repayments

% change

Debt- Equity

Ratio2

Short term borrowings Shareholder’s Equity - 0.11 -100%

Earnings for debt service = Net

profit after taxes + Non-cash

operating expenses + Finance

costs

10.37 5.31 95%

Return on Equity

ratio

Net Profit after taxes Average Shareholder’s

Equity

0.14 0.13 8%

Inventory

Turnover ratio

Cost of goods sold Average Inventory 4.37 3.99 10%

Trade Receivable

Turnover Ratio

Net credit sales = Gross credit

sales - sales return

Average Trade Receivable 3.55 3.44 3%

Trade Payable

Turnover Ratio

Net credit purchases = Gross

credit purchases - purchase

return

Average Trade Payables 2.73 2.70 1%

Net Capital

Turnover Ratio4

Net sales = Total sales - sales

return

Working capital = Current

assets – Current liabilities

1.97 9.76 -80%

Net Profit ratio5 Net Profit Net sales = Total sales -

sales return

0.06 0.03 100%

Return on Capital

Employed6

Earnings before interest and

taxes

Capital Employed =

Tangible Net Worth +

Total Debt + Deferred Tax

Liability

0.13 0.18 -26%

Return on

Investment

Interest (Finance Income) Investment NA NA NA

Note:

1. 2. 3. 4. 5. 6. Current ratio variance as compared to previous year is on account of proceeds received through QIP.

Debt equity ratio variance as compared to previous year is on account of repayment of borrowings during the year.

Debt service coverage ratio variance as compared to previous year is mainly due to increase in profits during the year.

Net capital turnover ratio variance as compared to previous year is mainly on account of increase in closing working

capital due to proceeds received through QIP.

Net profit ratio variance as compared to previous year is on account of improvement in operational profit margin.

Return on capital employed variance as compared to previous year is mainly on account of increase in closing capital

employed due to proceeds received through QIP.

280 Hitachi Energy India Limited