Page 273 - Hitachi IR 2025

P. 273

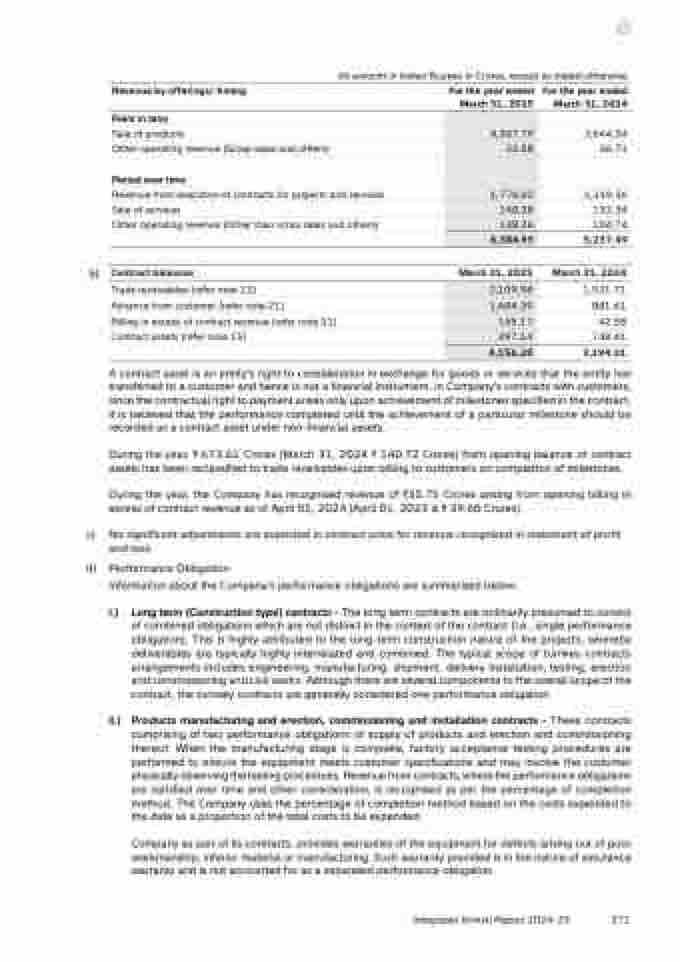

All amount in Indian Rupees in Crores, except as stated otherwise

Revenue by offerings/ timing For the year ended

March 31, 2025

For the year ended

March 31, 2024

Point in time

Sale of products 4,307.79 3,644.34

Other operating revenue (Scrap sales and others) 22.58 36.71

Period over time

Revenue from execution of contracts for projects and services 1,776.02 1,319.36

Sale of services 140.28 132.34

Other operating revenue (Other than scrap sales and others) 138.26 104.74

6,384.93 5,237.49

b) Contract balances Trade receivables (refer note 12) 2,109.58 1,521.71

Advance from customer (refer note 21) 1,604.39 881.61

March 31, 2025 March 31, 2024

Billing in excess of contract revenue (refer note 21) 145.17 42.58

Contract assets (refer note 15) 297.14 748.41

4,156.28 3,194.31

A contract asset is an entity’s right to consideration in exchange for goods or services that the entity has

transferred to a customer and hence is not a financial instrument. In Company’s contracts with customers,

since the contractual right to payment arises only upon achievement of milestones specified in the contract,

it is believed that the performance completed until the achievement of a particular milestone should be

recorded as a contract asset under non-financial assets.

During the year, ` 673.61 Crores (March 31, 2024 ` 140.72 Crores) from opening balance of contract

assets has been reclassified to trade receivables upon billing to customers on completion of milestones.

During the year, the Company has recognised revenue of `35.75 Crores arising from opening billing in

excess of contract revenue as of April 01, 2024 (April 01, 2023 is ` 39.60 Crores).

c) No significant adjustments are expected in contract price for revenue recognised in statement of profit

and loss.

d) Performance Obligation

Information about the Company’s performance obligations are summarised below:

i.) Long term (Construction type) contracts - The long term contracts are ordinarily presumed to consist

of combined obligations which are not distinct in the context of the contract (i.e., single performance

obligation). This is highly attributed to the long-term construction nature of the projects, whereby

deliverables are typically highly interrelated and combined. The typical scope of turnkey contracts

arrangements includes engineering, manufacturing, shipment, delivery installation, testing, erection

and commissioning and civil works. Although there are several components to the overall scope of the

contract, the turnkey contracts are generally considered one performance obligation.

ii.) Products manufacturing and erection, commissioning and installation contracts - These contracts

comprising of two performance obligations of supply of products and erection and commissioning

thereof. When the manufacturing stage is complete, factory acceptance testing procedures are

performed to ensure the equipment meets customer specifications and may involve the customer

physically observing the testing procedures. Revenue from contracts, where the performance obligations

are satisfied over time and other consideration, is recognised as per the percentage of completion

method. The Company uses the percentage of completion method based on the costs expended to

the date as a proportion of the total costs to be expended.

Company as part of its contracts, provides warranties of the equipment for defects arising out of poor

workmanship, inferior material or manufacturing. Such warranty provided is in the nature of assurance

warranty and is not accounted for as a separated performance obligation.

Integrated Annual Report 2024-25

271