Page 151 - Hitachi IR 2025

P. 151

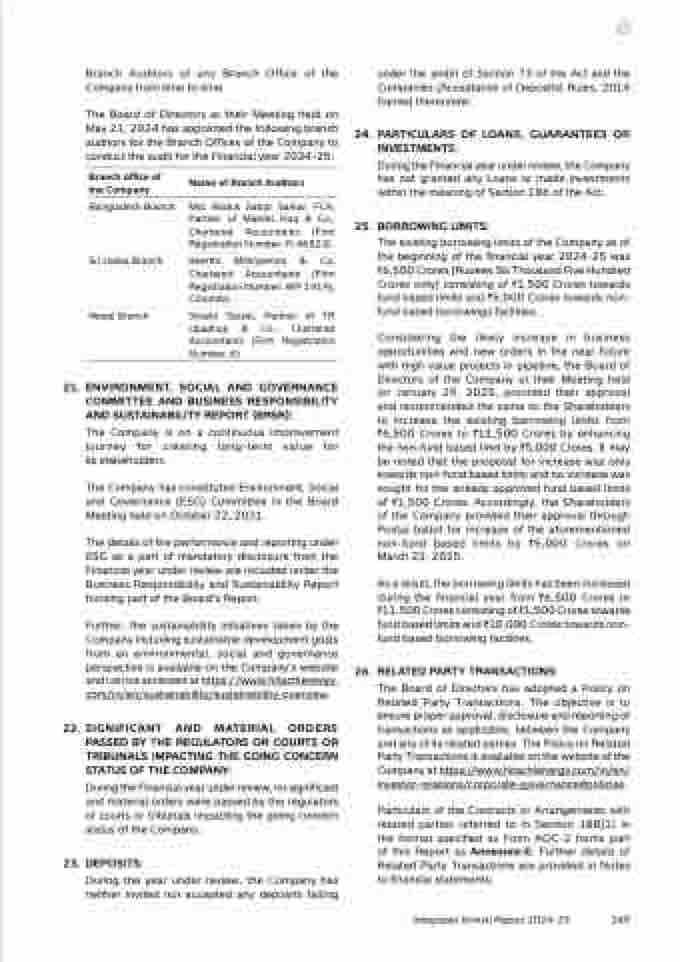

Branch Auditors of any Branch Office of the

Company from time to time.

The Board of Directors at their Meeting held on

May 21, 2024 has appointed the following branch

auditors for the Branch Offices of the Company to

conduct the audit for the Financial year 2024-25:

Branch office of

the Company Name of Branch Auditors

Bangladesh Branch Md. Abdus Sattar Sarkar, FCA,

Partner of Mahfel Huq & Co.,

Chartered Accountants (Firm

Registration Number: P-46323)

Sri Lanka Branch Keerthi Mihiripenna & Co,

Chartered Accountants (Firm

Registration Number: WP 1419),

Colombo

Nepal Branch Shashi Satyal, Partner of TR

Upadhya & Co., Chartered

Accountants (Firm Registration

Number: 6)

21. ENVIRONMENT, SOCIAL AND GOVERNANCE

COMMITTEE AND BUSINESS RESPONSIBILITY

AND SUSTAINABILITY REPORT (BRSR):

The Company is on a continuous improvement

journey for creating long-term value for

its stakeholders.

The Company has constituted Environment, Social

and Governance (ESG) Committee in the Board

Meeting held on October 22, 2021.

The details of the performance and reporting under

ESG as a part of mandatory disclosure from the

Financial year under review are included under the

Business Responsibility and Sustainability Report

forming part of the Board’s Report.

Further, the sustainability initiatives taken by the

Company including sustainable development goals

from an environmental, social and governance

perspective is available on the Company’s website

and can be accessed at https://www.hitachienergy.

com/in/en/sustainability/sustainability-overview.

22. SIGNIFICANT AND MATERIAL ORDERS

PASSED BY THE REGULATORS OR COURTS OR

TRIBUNALS IMPACTING THE GOING CONCERN

STATUS OF THE COMPANY:

During the Financial year under review, no significant

and material orders were passed by the regulators

or courts or tribunals impacting the going concern

status of the Company.

23. DEPOSITS:

During the year under review, the Company has

neither invited nor accepted any deposits falling

under the ambit of Section 73 of the Act and the

Companies (Acceptance of Deposits) Rules, 2014

framed thereunder.

24. PARTICULARS OF LOANS, GUARANTEES OR

INVESTMENTS:

During the Financial year under review, the Company

has not granted any Loans or made investments

within the meaning of Section 186 of the Act.

25. BORROWING LIMITS:

The existing borrowing limits of the Company as of

the beginning of the financial year 2024-25 was

`6,500 Crores (Rupees Six Thousand Five Hundred

Crores only) consisting of `1,500 Crores towards

fund based limits and `5,000 Crores towards non-

fund based borrowings facilities.

Considering the likely increase in business

opportunities and new orders in the near future

with high value projects in pipeline, the Board of

Directors of the Company at their Meeting held

on January 29, 2025, provided their approval

and recommended the same to the Shareholders

to increase the existing borrowing limits from

`6,500 Crores to `11,500 Crores by enhancing

the non-fund based limit by `5,000 Crores. It may

be noted that the proposal for increase was only

towards non-fund based limits and no increase was

sought for the already approved fund based limits

of `1,500 Crores. Accordingly, the Shareholders

of the Company provided their approval through

Postal ballot for increase of the aforementioned

non-fund based limits by `5,000 Crores on

March 23, 2025.

As a result, the borrowing limits has been increased

during the financial year from `6,500 Crores to

`11,500 Crores consisting of `1,500 Crores towards

fund based limits and `10,000 Crores towards non-

fund based borrowing facilities.

26. RELATED PARTY TRANSACTIONS:

The Board of Directors has adopted a Policy on

Related Party Transactions. The objective is to

ensure proper approval, disclosure and reporting of

transactions as applicable, between the Company

and any of its related parties. The Policy on Related

Party Transactions is available on the website of the

Company at https://www.hitachienergy.com/in/en/

investor-relations/corporate-governance#policies.

Particulars of the Contracts or Arrangements with

related parties referred to in Section 188(1) in

the format specified as Form AOC-2 forms part

of this Report as Annexure-E. Further details of

Related Party Transactions are provided in Notes

to financial statements.

Integrated Annual Report 2024-25

149