Page 144 - Hitachi IR 2025

P. 144

BOARD’S REPORT

Board’s Report

Dear Members,

The Board of Directors is pleased to present the 6th Integrated Annual Report covering the business and operations

of Hitachi Energy India Limited (“the Company”) along with the Company’s audited financials for the year ended

March 31, 2025.

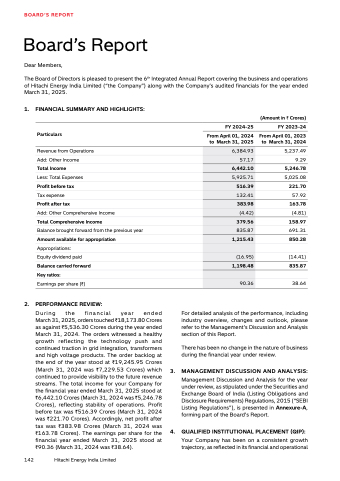

1. FINANCIAL SUMMARY AND HIGHLIGHTS:

(Amount in ` Crores)

FY 2024-25 FY 2023-24

Particulars

From April 01, 2024

to March 31, 2025

From April 01, 2023

to March 31, 2024

Revenue from Operations 6,384.93 5,237.49

Add: Other Income 57.17 9.29

Total Income 6,442.10 5,246.78

Less: Total Expenses 5,925.71 5,025.08

Profit before tax 516.39 221.70

Tax expense 132.41 57.92

Profit after tax 383.98 163.78

Add: Other Comprehensive Income (4.42) (4.81)

Total Comprehensive Income 379.56 158.97

Balance brought forward from the previous year 835.87 691.31

Amount available for appropriation 1,215.43 850.28

Appropriations:

Equity dividend paid (16.95) (14.41)

Balance carried forward 1,198.48 835.87

Key ratios:

Earnings per share (`) 90.36 38.64

2. PERFORMANCE REVIEW:

During the financial year ended

March 31, 2025, orders touched `18,173.80 Crores

as against `5,536.30 Crores during the year ended

March 31, 2024. The orders witnessed a healthy

growth reflecting the technology push and

continued traction in grid integration, transformers

and high voltage products. The order backlog at

the end of the year stood at `19,245.95 Crores

(March 31, 2024 was `7,229.53 Crores) which

continued to provide visibility to the future revenue

streams. The total income for your Company for

the financial year ended March 31, 2025 stood at

`6,442.10 Crores (March 31, 2024 was `5,246.78

Crores), reflecting stability of operations. Profit

before tax was `516.39 Crores (March 31, 2024

was `221.70 Crores). Accordingly, net profit after

tax was `383.98 Crores (March 31, 2024 was

`163.78 Crores). The earnings per share for the

financial year ended March 31, 2025 stood at

`90.36 (March 31, 2024 was `38.64).

142 Hitachi Energy India Limited

For detailed analysis of the performance, including

industry overview, changes and outlook, please

refer to the Management’s Discussion and Analysis

section of this Report.

There has been no change in the nature of business

during the financial year under review.

3. MANAGEMENT DISCUSSION AND ANALYSIS:

Management Discussion and Analysis for the year

under review, as stipulated under the Securities and

Exchange Board of India (Listing Obligations and

Disclosure Requirements) Regulations, 2015 (“SEBI

Listing Regulations”), is presented in Annexure-A,

forming part of the Board’s Report.

4. QUALIFIED INSTITUTIONAL PLACEMENT (QIP):

Your Company has been on a consistent growth

trajectory, as reflected in its financial and operational